Talking Concepts

June 2024

Important News when emailing our team

The team at Concepts & Results all have their own cr.com.au email address and please feel free to email them direct. However, be mindful if the team member is on leave, they may not respond to your email straight away.

If you are unsure which team member to email, please send your emails to admingroup@cr.com.au Our admin team will receive and forward your email to the relevant team member to attend to your request and respond.

Some clients have used our gmail.com in the past and we would ask if you do have this email address recorded, that you do not send any emails to this address unless specifically asked to by a team member. We only have this email for times when clients are unable to email our cr.com.au email or our email server is down (which has never happened).

You may also notice the email address conceptsgroup@practicemanagerfiles.com. This email address is used to record your emails within a specific job that we are doing for you at the time. We ask that you do not send emails to this address unless it is cc’d in an email regarding work that we are doing.

Dates to Remember

30th June 2024 – End of Financial Year

01st July 2024 – SGC rate increases to 11.5%

14th July 2024 – STP EOFY finalisation declarations lodged for employers

14th July 2024 – PAYG payment summaries available to employees via their myGov

28th July 2024 – Superannuation Guarantee Charge (SGC) for 1 April to 30 June payment due date

* Please check your clearing house’s June superannuation processing cut off date if you’d like this as a tax deduction for the current financial year.

28th August 2024 – Building & Construction TPAR due

INTEREST RATES

Interest Rates that start from…

5.79% p/a Fixed Rate

6.45% p/a Comparison Rate

Based on our lender panel, Heritage Bank’s 3 Year Fixed Rate, provides the most competitive Interest Rate. Interest rates are correct as at 19/06/2024 and subject to change at anytime. The comparison rate is based on a loan amount of $500,000, over a 30 year term. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees and other loan amounts might result in a different comparison rate. Terms, conditions, fees and charges apply and your full financial situation would need to be reviewed prior to acceptance of any offer or product.

C&R Updates

Concepts & Results are happy to welcome Karlo to our Admin team!

We are also excited to welcome Angelica to our Financial Planning team!

You may have already been introduced to them on the phone or via email.

Interest on early ATO payments

Payments eligible for IEP

Interest on early payments (IEP) is interest the ATO pay when you make a payment towards any of the following tax liabilities more than 14 days before the due date:

- income tax (including Medicare levy and Medicare levy surcharge)

- compulsory Higher Education Loan Program (HELP) repayments

- compulsory Vocational Education and Training Student Loan (VETSL) repayments

- Student Financial Supplement Scheme (SFSS) assessment debts

- compulsory Student Start-up Loan (SSL) repayments

- compulsory ABSTUDY Student Start-up Loan (SSL) repayments

- compulsory Trade Support Loan (TSL) debt repayments

- interest on distributions from non-resident trust estates

- shortfall interest charge (SIC).

Tax treatment of IEP

Interest on early payments is assessable income. Include any IEP in your tax return in either the:

- income year you receive the interest payment

- income year it is offset against another tax debt you had with us.

Payments not eligible for IEP

The following payments are not eligible for IEP:

- pay as you go (PAYG) withholding amounts including

- amounts withheld from interest, dividends and royalties

- amounts withheld by payers (including those withheld for the purpose of repaying contributions or debts for HELP, VETSL SFSS, TSL, SSL or ABSTUDY SSL)

- PAYG instalments

- self-managed super fund (SMSF) supervisory levy payments

- any part of a payment that exceeds the amount that is due and payable.

Statement of Account

A Statement of Account (SoA) will be sent when the IEP credit is refunded or offset against an existing debt. For:

- individuals – use myGovExternal Link to view your SoA

- businesses – use Online services for business (OSB) to view your SoA

- Or you will be issued your SOA via our office

Payment of IEP

From March 2022, the ATO automated the calculation and payment of IEP entitlements for eligible early payments. This process applies to amounts you have paid us since 1 July 2021.

The ATO calculate and pay IEP after the due date of the tax debt has passed. We only pay IEP if your interest amount is $0.50 or more and it may be used to offset income tax and other debts.

IEP is paid directly to your nominated bank account, so make sure your financial institution account details are up to date.

If your financial institution account details are not up to date, we will pay you by cheque for IEP entitlements over $9.99. Lesser amounts will remain on your account for a maximum of 12 months provided the amount has not been offset against an outstanding tax debt or paid with another credit. If your financial institution account details are not up to date after 12 months, then the IEP credit will issue by cheque.

If you update your financial institution account details within the 12-month period, then the IEP credit will be paid directly to your nominated bank account after the 12 months have passed.

ASIC brings first action against a director for failing to have a director identification number

Source: ASIC 25 March 2024

ASIC has commenced the first prosecution action against a director for failing to comply with the obligation to have a director identification number (director ID).

On 19 March 2024, a director appeared in the Downing Centre Local Court and was formally charged with one count of contravening section 1272C(1) of the Corporations Act 2001 by failing to have a director ID. An interim non-publication order (NPO) was granted by the Court prohibiting the identification of the defendant. The charges were listed for a further mention before the Downing Centre Local Court on 16 April 2024.

On 22 March 2024, the interim NPO was extended to 16 April 2024.

Background

All directors are required by law to verify their identity with Australian Business Registry Services before receiving a director ID. Directors must apply for their director ID within the following timeframes:

- Directors appointed before 1 November 2021 had until 30 November 2022 to apply.

- New directors appointed for the first time between 1 November 2021 and 4 April 2022 had 28 days form their appointment to apply.

- From 5 April 2022, intending new directors must apply before being appointed.

The maximum penalty for an offence against section 1272C(1) of the Act is 60 penalty units. The defendant in this matter is facing a maximum penalty of $13,320.

If you are a director of a company and do not yet have your Director ID, we suggest that you obtain one asap. For guidance on how to obtain please contact our office.

Overview of Australian Taxation Office (ATO) Taxes in Victoria

The Australian Taxation Office (ATO) is the principal revenue collection agency for the federal government of Australia, administering various taxes that apply across all states and territories, including Victoria. These taxes fund a range of public services and infrastructure at both federal and state levels. Here, we summarize the key types of taxes managed by the ATO that affect individuals and businesses in Victoria.

1. Income Tax:

Income tax is the most significant source of revenue for the federal government. It is levied on the taxable income of individuals, businesses, and other entities. In Australia, income tax rates are progressive, meaning they increase as income increases. Key components include:

- Individual Income Tax: Applies to earnings such as salaries, wages, and investment income. The tax rates range from 0% for incomes up to $18,200 to 45% for incomes over $180,000.

- Business Income Tax: Companies pay a flat rate of 30%, or 25% for small businesses with an aggregated turnover of less than $50 million.

2. Goods and Services Tax (GST):

The GST is a broad-based consumption tax of 10% on most goods, services, and other items sold or consumed in Australia. Businesses registered for GST must include it in the price of taxable goods and services and remit the collected GST to the ATO. The revenue from GST is distributed to the states and territories, including Victoria.

3. Fringe Benefits Tax (FBT):

FBT is levied on non-cash benefits that employers provide to their employees, such as company cars, low-interest loans, or gym memberships. The tax is paid by the employer at a rate of 47% on the grossed-up value of the benefits provided.

4. Superannuation Taxes

The ATO oversees the taxation of superannuation funds, which are retirement savings accounts for Australian workers. Key aspects include:

- Superannuation Guarantee (SG): Employers must contribute a minimum percentage of an employee’s ordinary time earnings to a superannuation fund. The rate is 11% as of 2024.

- Contributions Tax: Contributions to superannuation funds are taxed at 15%.

- Earnings Tax: Investment earnings within the superannuation fund are also taxed at 15%.

5. Capital Gains Tax (CGT):

CGT is applied to the profit from the sale of assets, such as property, shares, or businesses. For individuals, the gain is added to their income and taxed at their marginal tax rate. There are various exemptions and concessions, such as the 50% discount for assets held for more than 12 months by individuals.

6. Medicare Levy

The Medicare Levy is a tax to fund Australia’s public healthcare system. It is typically 2% of an individual’s taxable income. High-income earners without private health insurance may also incur the Medicare Levy Surcharge, which ranges from 1% to 1.5% of their income.

7. Luxury Car Tax (LCT)

LCT is levied on the purchase of cars above a certain value threshold. As of 2024, the threshold is $69,152 for fuel-efficient vehicles and $75,526 for other vehicles. The tax rate is 33% on the value exceeding the threshold.

8. Foreign Resident Withholding Taxes

Non-residents earning income from Australian sources may be subject to withholding taxes. These include taxes on interest, dividends, and royalties, with rates varying depending on tax treaties between Australia and the non-resident’s home country.

The ATO administers a comprehensive tax system that supports federal and state programs, including those in Victoria. Understanding these taxes is essential for compliance and for appreciating how they contribute to the public services and infrastructure that benefit all Australians. For detailed information and specific advice, individuals and businesses should consult the ATO’s resources or seek professional guidance.

Understanding the Difference Between

Power of Attorney and Enduring Power of Attorney

Legal instruments such as Power of Attorney (POA) and Enduring Power of Attorney (EPOA) are crucial for managing financial, legal, and personal affairs. Both documents allow a person (the principal) to appoint another person (the attorney) to act on their behalf. However, there are significant differences between the two, particularly in terms of duration and scope of authority. This article explains these differences in detail.

Power of Attorney (POA)

A Power of Attorney is a legal document that grants someone the authority to act on behalf of the principal in specific situations or for a limited period. Key features include:

-

Scope of duration: A POA is typically used for short-term or specific transactions. It might be used, for example, if the principal is travelling overseas and needs someone to manage their financial affairs temporarily.

-

Activation: The authority of a POA usually comes into effect immediately upon signing, unless specified otherwise in the document. It remains in force until it is revoked by the principal or until a specified end date or event occurs.

-

Termination: A POA automatically terminates if the principal loses mental capacity, becomes bankrupt, or dies. It is not designed to be used for long-term planning, especially in cases where the principal might become incapacitated.

Types of POA:

- General POA: Covers a wide range of activities, such as managing bank accounts, paying bills, and selling property.

- Specific POA: Limited to particular tasks or transactions, like selling a car or signing a lease agreement.

Enduring Power of Attorney (EPOA)

An Enduring Power of Attorney is a legal document that not only allows someone to act on the principal’s behalf but also remains valid even if the principal loses mental capacity. Key features include:

Scope and Duration: EPOAs are intended for long-term planning and can cover a broad range of decisions, including financial, legal, and sometimes personal matters.

Activation: An EPOA can be designed to come into effect immediately upon signing or only when the principal loses mental capacity, depending on the principal’s preference.

Endurance: The main feature of an EPOA is that it continues to be in effect even if the principal becomes mentally incapacitated. This provides a safeguard for situations where the principal can no longer make decisions for themselves.

Types of EPOA:

- Financial EPOA: Allows the attorney to manage the principal’s financial and legal affairs, such as handling bank accounts, real estate transactions, and investments.

- Personal EPOA: In some jurisdictions, including Victoria, there is a distinction for personal matters, which may include lifestyle and healthcare decisions. However, in Victoria, personal matters are often managed under a separate instrument known as an Enduring Power of Attorney (Medical Treatment) or via an appointed Medical Treatment Decision Maker.

KEY DIFFERENCES:

Purpose and Use: POAs are typically for short-term or specific tasks, while EPOAs are meant for long-term and ongoing decision-making, particularly when the principal can no longer manage their affairs.

Mental Capacity: The primary difference between a POA and an EPOA is related to the principal’s mental capacity. A POA becomes invalid if the principal loses mental capacity, whereas an EPOA remains valid and continues to function.

Legal Protection: An EPOA offers more comprehensive protection for the principal, ensuring that their financial and personal affairs are managed even if they become incapacitated. This continuity is not available with a standard POA.

Revocation and Termination: A POA can be easily revoked by the principal as long as they have the capacity to do so. An EPOA, however, remains effective through the principal’s incapacity unless formally revoked while the principal is still mentally capable.

Understanding the differences between a Power of Attorney and an Enduring Power of Attorney is essential for effective legal and financial planning in Victoria. A POA provides flexibility for managing specific tasks over a limited period, whereas an EPOA offers long-term security, ensuring that a trusted person can manage affairs if the principal loses capacity. For personalised advice and to ensure the appropriate documentation is in place, it is advisable to consult a legal professional specialising in estate planning.

To Fix or Not to Fix?

There is no doubt that trusts play an integral role in business and investment structuring, offering asset protection, tax planning flexibility and succession mechanisms.

Amongst the many different types of trusts that can be used, unit trusts feature prominently, however within the realm of unit trusts there are multiple, nuanced variations.

Terms such as “fixed”, “non-fixed”, “special”, “fixed for tax purposes” and “fixed for land tax purposes” are often used to categorise some of these variations. And while they all share similarities, they also possess distinct characteristics that can significantly impact structuring strategies and outcomes.

Unit Trusts:

A unit trust is a trust in which there is an equitable obligation on a person or company (trustee) to deal with property (trust property) for the benefit of beneficiaries (unit holders). The unit holders hold defined entitlements to the income and capital of the trust, referred to as units.

Unit trusts are commonly used for unrelated parties to pool their funds for business or investment ventures. A non-fixed unit trust might allow the trustee to issue varying classes of units with different rights attaching to each class, similar to different share classes in a company.

Other unit trusts, such as some fixed unit trusts, might be far more restrictive in terms of the trustee’s discretions (or lack thereof) to distribute income and capital of the trust.

It is the distinct characteristics of different unit trusts that determine if the trust and/or its unit holders, enjoy various tax benefits. Unit trusts are not always fixed trusts and fixed unit trusts are not always fixed for land tax purposes.

Fixed Unit Trusts for Tax Purposes:

There are potential tax benefits of using a unit trust that qualifies as a fixed trust for tax purposes. It will generally be easier for the trust to carry forward losses and qualify for certain CGT concessions. It will also generally be easier for unit holders to claim borrowing costs associated with acquiring units and franking credits if they receive dividends from underlying investments.

The Income Tax Assessment Act 1936 (Cth) (ITAA) stipulates that a trust is a fixed trust if persons have fixed entitlements to all of the income and capital of the trust. Unit holders will be classified as having that fixed entitlement to the income and capital if they have a vested and indefeasible interest in a share of income or capital of the trust.

Whilst the legislation makes it seemingly difficult to establish a fixed entitlement with certainty, the ITAA does provide the Commissioner with the discretion to deem that a unit holder has a fixed entitlement, having regard to:

- the circumstances in which an entitlement is not vested and indefeasible;

- the likelihood of the entitlement not vesting or the defeasance happening;

- and the nature of the trust.

Further, PCG 2016/16 outlines the factors the Commissioner will consider when deciding whether to exercise the discretion to treat an interest in the income or capital of a trust as being a fixed entitlement and outlines a safe harbor compliance approach for trustees.

Fixed Unit Trusts for NSW:

Land Tax Purposes

In New South Wales, for a unit trust to enjoy the benefit of the land tax-free threshold of $1,075,000 (for the 2024 land tax year), it needs to qualify as a fixed trust in accordance with the Land Tax Management Act 1956 (NSW) (LTMA).

The LTMA stipulates that if a trust satisfies relevant criteria, the trust is taken to be a fixed trust and therefore enjoys the benefit of the land tax-free threshold.

The relevant criteria to be satisfied for a unit trust to be classified as a fixed trust for NSW land tax purposes are:

- the trust deed specifically provides that the beneficiaries of the trust:

are presently entitled to the income of the trust, subject only to payment of proper expenses by and of the trustee relating to the administration of the trust; and - are presently entitled to the capital of the trust, and may require the trustee to wind up the trust and distribute the trust property or the net proceeds of the trust property,

- the entitlements referred to above cannot be removed, restricted or otherwise affected by the exercise of any discretion, or by a failure to exercise any discretion, conferred on a person by the trust deed

- there must be only one class of units issued.

- the proportion of trust capital to which a unit holder is entitled on a winding up or surrender of units must be fixed and must be the same as the proportion of income of the trust to which the unit holder is entitled.

It is important to note that even when a trust satisfies the relevant criteria, the full benefit of the land tax-free threshold might not always be received.

This occurs where a fixed trust for NSW land tax purposes has non-fixed (“special”) trust unit holders. In thesesituations, the special trust unit holder/s would be taxed (assecondary taxpayers) on their proportion of the unit holdings,without the benefit of the land tax-free threshold.

Effective Structuring

It can be surprisingly easy to confuse the different types of unit trusts and fixed trusts, leading to potentially damaging and costly outcomes for trustees and their advisors.

As always, our team is here to help, so feel free to contact us to discuss setting up new trusts and amending existing trusts to ensure structuring strategies achieve desired outcomes.

Spotlight on Scams

Source Macquarie Bank

Last year, Australians lost over $2.7 billion to scams, while scam reports increased over 18% to more than 600,000.

As we approach the halfway mark of 2024, scams continue to be a serious problem for many Australians so it’s worth refreshing your knowledge and keeping up to date with the latest information.

We’re here to help, so we’re sharing our latest insights on which scams are on the rise and how to stay protected, plus tips and resources so you always know what to look out for when it comes to scams.

Impersonation scams

You’ve likely heard of the ‘collect your parcel’ or ‘Hi Mum and Dad’ scams. Scammers impersonate trusted organisations such as banks, businesses, or government agencies. They may even impersonate a friend or member of your family. They’ll generally contact you via phone call or email with an urgent request to take action and often include links in their email or SMS.

Security tip: If you’re unsure about a message you’ve received, contact the person allegedly reaching out through other channels to confirm they are who they claim, and never send money unless you’re certain it’s going to the right person

Buying or selling scams

Scammers on resale websites, such as Facebook Marketplace, target both buyers and sellers. They may ask to move your conversation to a different platform, tell you that they’ve overpaid you and are requesting a refund, ask that you pay their shipping costs upfront, or want to use an unusual payment method such as gift cards or cryptocurrencies.

Security tip: Don’t share additional personal information such as your email address or driver’s licence. If you’re picking up the item at a physical location, it’s recommended that you obtain and verify the address before making any payments. If you’re in doubt, don’t proceed

Remote access scams

Scammers will make unsolicited contact with their target, often claiming to be an IT professional or a member of an organisation’s fraud and security team who has identified a possible problem. They create a sense of urgency and request access to your computer or mobile phone and ask you to log into your bank account, make payments, or confirm security codes.

Security tip: Always keep your computer software up to date and never share your personal information or account details over the phone. Don’t download remote access software or share screens with a third party. A bank will never ask you to provide access to your computer or device.

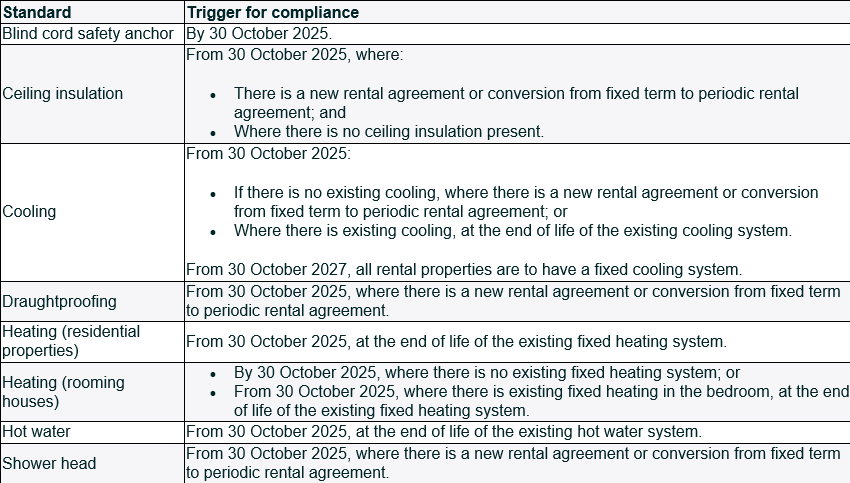

Minimum Standards for Rental Properties and Rooming Houses

In Victoria, minimum rental standards including the cleanliness, privacy, security and amenity for rental properties and rooming houses are prescribed under the Residential Tenancies Regulations 2021 and the Residential Tenancies (Rooming House Standards) Regulations 2023 (the current Regulations), both made under the Residential Tenancies Act 1997.

In line with the Victorian Government’s commitments under the Gas Substitution Roadmap Update and the transition towards net zero emissions by 2045, additional minimum standards for rental properties and rooming houses relating to energy efficiency are proposed to ensure that renters and rooming house residents are provided with comfortable and energy efficient living arrangements. A standard for blind cord safety anchors is also proposed to increase safety in all rental properties.

The Residential Tenancies and Residential Tenancies (Rooming House Standards) Amendment (Minimum Energy Efficiency and Safety Standards) Regulations 2024 (the proposed Regulations) will prescribe minimum standards for ceiling insulation, draughtproofing, hot water systems, cooling, and the uplift of current standards for heating and shower roses in rental properties; a new heating standard for rooming houses, and a new safety standard for blind cord anchors to apply to all rental properties.

The proposed Regulations are expected to be made in October 2024. To allow sufficient time for compliance, a staged commencement of each standard is proposed. Compliance with the standards will be triggered differently for each standard, commencing from a date 12 months after the proposed Regulations are made.

The proposed Regulations also provide a range of exemptions in relation to each standard recognising practical difficulties that may arise for some rental providers in meeting the proposed standards, such as conflicting owners corporation rules or where an appliance is being replaced under a manufacturer, supplier, or installer warranty.

A Regulatory Impact Statement (RIS) has been prepared that examines the costs and benefits of the proposed Regulations.

For more information, or to have your say and provide feedback go to https://engage.vic.gov.au/new-minimum-standards-for-rental-properties-and-rooming-houses

Have you visited our Bookkeeping Department Website yet?

Unleash business potential at tax-time

Wherever your business is headed next, take it further with Prospa funding.

Realise your business vision sooner with funding.

Prospa Small Business Loan

-

Loan Amount: $5k - $150k

-

Term: 3 - 36 month terms

-

Security: No asset security required upfront access up to $150k in Prospa funding

-

Offer: no repayments on Prospa business loans up to $500k for the first 6 weeks to eligable established small businesses.

Prospa Business Loan Plus

-

Loan Amount: $150k - $500k

-

Term: 12 - 36 month terms

-

Security: For access to prospa funding above $150k, Prospa will register secuirty over the business assets on the governments Personal Property Security Registry (PPSR)

-

Offer: no repayments on Prospa business loans up to $500k for the first 6 weeks to eligable established small businesses.

Prospa Business Line of Credit

-

Facility Amount: $2k - $150k

-

Term: 24-month term

-

Security: No asset security required upfront access up to $150k in Prospa funding

RBA to hold the line in June decision

Major bank economists expect the Reserve Bank of Australia (RBA) to keep the cash rate at 4.35% in June. Westpac’s Matthew Hassan says recent data shows restrictive policies are helping control inflation but the outlook remains uncertain. Commonwealth Bank’s Gareth Aird notes that economic data aligns with RBA forecasts, particularly on unemployment, suggesting no rate change is needed. ANZ has postponed its cash rate cut prediction to February 2025 from November 2024, citing the current effectiveness of monetary policies.

In conclusion, the RBA is likely to maintain its cautious approach as it monitors inflation and economic data, with no immediate changes to the cash rate expected.

Digital ID Bill passes through Parliament

Souce: The Adviser

The Digital ID Bill 2023 has passed through the Australian Parliament, paving the way for an expanded digital identity system that includes both state and territory governments and the private sector. Key aspects of the bill include:

Legislation and Amendments:

- The bill establishes an economy-wide Digital ID Accreditation Scheme.

- It includes new security requirements and data collection restrictions to combat identity theft and fraud.

- Amendments allow accredited private businesses, such as banks, to join the government’s Digital ID System within two years of the Act’s commencement.

Consultation and Advisory Stakeholder Group:

- The bill followed a period of consultation, with input from stakeholders including David Gandolfo of the Commercial and Asset Finance Brokers Association of Australia Limited (CAFBA).

Benefits and Reactions:

- Minister for Finance, Katy Gallagher: Emphasized the bill’s role in simplifying and securing access to government services online.

- Australian Banking Association (ABA): Highlighted the benefits of a voluntary nationwide Digital ID for privacy and data protection, efficient identity verification, and reducing identity fraud and theft. ABA’s CEO Anna Bligh mentioned it would facilitate quick and secure bank account openings and enhance the fight against scams.

Long-term Impact:

- Assistant Treasurer and Financial Services Minister Stephen Jones: Stressed the importance of Digital ID in securing financial transactions and protecting Australians’ information from scammers and criminals.

This new legislation is expected to see broader adoption of Digital ID for activities like opening bank accounts and applying for mortgages, significantly enhancing security and convenience for Australians.

Have you visited our Loans Department Website yet?

WATCH NOW

Electronic Signing

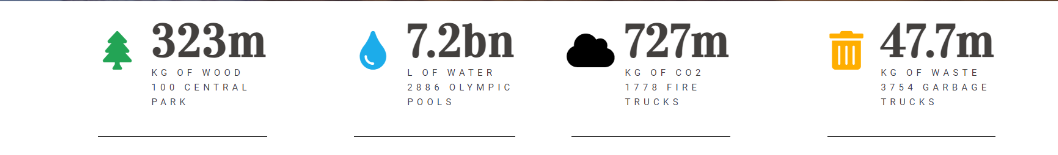

At Concepts & Results we ask you to sign documents electronically whenever possible. This can be via Xero, Docusign, or Adobe sign. You’ve helped save…

See our previous newsletters below

Visit us

Want to discuss the above face to face? Come visit our specialised team members to find out more.

612 Warrigal Road, East Malvern PO Box 61, Holmesglen, Vic 3148

Call us

Have any questions? Further discussions on the above can be may be held over a telephone appointment.

Contact us

For any and all queries regarding the above, you may contact Concepts & Reuslts by emailing us

DISCLAIMER: Whilst all care is taken in the preparation of the material in this newsletter, the information provided is of a general nature and individuals should seek advice as to their own specific needs. Accordingly, no responsibility for errors or omissions is accepted by Concepts & Results group of companies or any member or employee.