Talking Concepts

December 2024

What's been going on this quarter? Stay current with Concepts & Results and any updates in the market

We would love to get your feedback!

Both good and bad, we want to know how we can improve our service for you.

See the links below where you can leave us a review for our departments

Dates to Remember

21 December 2024 – Monthly IAS & monthly BAS lodgement and payment due

20 December 2024 – Office closes for Christmas break

8th January 2025 – Office re-opens

15th January 2025 – December 2024 Payroll Tax (Date extended, normally due 7th)

28th January 2025 – December Quarterly Super Due

INTEREST RATES

Interest Rates that start from…

5.49% p/a Fixed Rate

6.37% p/a Comparison Rate

Based on our lender panel, Heritage Bank’s 3 Year Fixed Rate, provides the most competitive Interest Rate. Interest rates are correct as at 26/11/2024 and subject to change at anytime. The comparison rate is based on a loan amount of $500,000, over a 30 year term. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees and other loan amounts might result in a different comparison rate. Terms, conditions, fees and charges apply and your full financial situation would need to be reviewed prior to acceptance of any offer or product.

Join our Facebook & Instagram groups

Stay connected and in the loop! Join our Facebook and Instagram groups for updates, tips, and a community that shares your interests. Don’t miss out—be part of the conversation!

Reminder: Get Ready for Your 2024 Tax Return

Haven’t submitted your 2024 Tax Return yet? Now’s the time to start gathering your documents and planning ahead. To avoid the rush, we recommend contacting our office early in the new year for assistance.

Not sure when your return is due? Email us at admingroup@cr.com.au, and we’ll help you stay on track. Don’t wait—let’s get your tax sorted!

Managing Personal and Business Services with myID

Personal myGov Account:

- A personal myGov account is intended for individual use, such as accessing tax, Medicare, and Centrelink services.

- Unfortunately, you cannot directly link a business ABN to a personal myGov account

Linking Business ABN:

- To manage business-related services, you still need to use myGovID, which is a separate identity system from myGov and designed for business access.

- myGovID allows individuals to access business-related government services securely and is linked to their ABN.

Steps to Link a Business ABN to myGovID:

- Set up a myGovID account using the myGovID app.

- Once myGovID is set up, you can link your business ABN through the Australian Business Register (ABR) or directly via the ATO’s online services.

- After linking the ABN to myGovID, you will be able to access business-related government services via the Business Portal or through the ATO’s online platform.

Can One myGovID Be Used for Personal and Business?

- Yes, you can use a single myGovID for both personal and business purposes, but they are treated separately. The personal myGov account remains for individual services, while business-related services are accessed through the Business Portal using myGovID

After linking, you can access all business services through the ATO’s Business Portal or directly via myGovID.

Property Update for November 2024

✍️ Corelogic

1. Residential real estate value reached $11.1 trillion by the end of October, with national home values holding steady at 0.9% over the quarter. 2. Home value growth is strongest in the more affordable end of the market, with Adelaide, Perth, and Brisbane seeing the fastest rises in the most affordable 25% of homes. 3. Darwin, Melbourne, and Sydney have seen some of the largest declines in home values in the upper quartile market over the quarter. 4. There were 43,232 sales in October, with a total of 522,401 sales in the 12 months to October, a slight decrease from the previous year. 5. Days on market has increased to 33 days, up from 27 days last year, with most capitals experiencing longer days on the market due to rising advertised stock levels providing more choice for buyers. |

National Residential Overview

✍️ Herron Todd White

1. Property ownership is ingrained in Australian culture as the Australian Dream, but has become increasingly difficult for first homebuyers due to affordability constraints and a lack of supply. 2. State and federal governments offer incentives for first homebuyers, with one in three first homebuyers taking advantage of the Home Guarantee Scheme in the financial year 2024. 3. The challenge for first homebuyers is navigating rising markets, with cities like Brisbane, Adelaide, and Perth experiencing significant annual growth in property prices. 4. The national average first homebuyer home loan size is approximately $498,000, with metropolitan first homebuyers having a higher average loan size compared to regionally based first homebuyers. 5. While the climate to buy is challenging for first homebuyers, there are opportunities in both capital cities and regional areas throughout Australia, with various strategies being employed to achieve the Australian Dream of property ownership. |

Who is responsible for repairs and maintenance of the premises?

A rental property must always be in a suitable state for tenants to live in. While a rental property doesn’t need to be in perfect condition, a landlord must keep it in a reasonable state of repair considering its age and the rent charged. Tenants, too, have a responsibility to keep the property in a state of cleanliness considering the state of the property when the tenancy began.

Occasionally disputes arise, leaving people to wonder, who is responsible for repairs and maintenance of the premises – the landlord or the tenant?

Here is a rundown of some of the things that are commonly contested.

- Pest control

- Fire safety

- Gardens

- Plumbing

PEST CONTROL:

Is pest control the responsibility of a landlord or tenant?

It is a landlord’s responsibility to ensure their rental property meets the standards of health and safety laws. Meanwhile, the Residential Tenancies Act 1997 states that tenants must take reasonable care of and keep the premises reasonably clean.

Generally, a landlord is accountable for pest and vermin issues at the beginning of a tenancy, and a tenant is responsible after they move in.

But of course, there are exceptions.

Say a cockroach infestation is caused by a hole in the wall and not the tenant’s lack of cleanliness. In this case, the tenant may not be held responsible for eradication. However, if the infestation is due to the tenant failing to remove rubbish, then the eradication would likely fall on the tenant.

In the event of a dispute, other factors that could determine who is responsible for pest control on the premises include the history of the property, what is recorded in the condition report, and if there were factors beyond the tenant’s control.

FIRE SAFETY:

Smoke alarm rules vary across Australia, but generally they must meet Australian Standards. Landlords are obliged to fit their rental property with compliant smoke alarms as defined by the relevant state or territory legislation. Failure to do so can result in penalties.

To find out more about smoke alarm legislation, read Australian smoke alarms regulations and rules for landlords.

GARDENS:

Living in a rental property with a beautiful garden can be great, but gardens require maintenance to keep them looking good.

Yard work such as mowing, edging and weeding is usually the responsibility of the tenant, unless the tenancy agreement states otherwise.

Major works such as tree lopping or hedges that require specialist upkeep are normally the responsibility of the landlord.

Outdoor area maintenance arrangements should be listed in the tenancy agreement and noted in the entry and exit condition reports.

PLUMBING:

The upkeep of plumbing is a frequent point of contention. Essentially, both landlords and tenants play a part in the maintenance of plumbing in a rental property.

It is the landlord’s job to ensure the property’s plumbing is in a safe state and suitable for tenants. And once a tenant has signed the tenancy agreement, it is up to them to take good care of the property and maintain the functional aspects including plumbing.

This means that the tenant should be diligent in preventing issues like blockages by keeping the property clean and not flushing things down drains.

Again, all the requirements around who will take responsibility for the issues that may arise during the tenancy term – and each person’s rights – should be laid out in the Residential Tenancy Agreement.

In the case of an emergency such as a burst water pipe or broken toilet, the landlord should be called to contact a plumber. If the plumber finds the issue was caused by tenant negligence, it would be the tenant’s responsibility to pay for the work.

If the landlord or real estate agent cannot be contacted or can’t attend to any urgent repairs in a suitable timeframe, the tenant can arrange the repairs. It is advisable the tenant doesn’t pay more than $1,000 as the landlord is only required to pay for any reasonable costs up to this amount. The tenant must give the landlord or agent written notice about the repairs, costs and copies of receipts. The landlord is obliged to pay this within 14 days of notice.

BMT’s Rate Finder calculator finds the effective life and depreciable rate of plant and equipment assets for rental properties which can assist with disputes over damaged assets and maintenance and replacement scheduling. Call BMT on 1300 728 726 for more information.

The Truth Behind Rising Construction Costs | 2024 Update

Payday Super: What You Need to Know

From 1 July 2026, employers will align superannuation payments with wages, eliminating the current quarterly system. This reform ensures employees receive their super contributions more frequently, boosting retirement savings and curbing unpaid super incidents, which are likened to wage theft.

Key Changes for Employers:

- Super Due Dates: Employers must pay Superannuation Guarantee (SG) contributions within 7 days of payday.

- Updated SG Charge: Late or incomplete payments will incur penalties, including daily interest and administrative charges.

- Simplified Corrections: Late contributions will count towards the earliest unpaid period automatically, simplifying compliance.

Benefits for Employees:

- Improved tracking of super payments, enabling earlier action against unpaid contributions.

- Higher retirement savings from timely contributions.

Transition Support:

- Super funds must process contributions faster—within 3 business days.

- Enhanced payroll software will replace the ATO’s Small Business Superannuation Clearing House.

- Clearer onboarding rules will reduce duplicate accounts and improve fund choice.

Compliance Monitoring:

The ATO will leverage Single Touch Payroll (STP) data for real-time oversight, identifying and addressing unpaid super promptly.

This reform strengthens Australia’s superannuation system, ensuring fairer outcomes for employees and smoother processes for employers. Stay tuned for updates as the legislative framework is finalized in late 2024.

Insights & Expertise: Explore Our Latest Articles

Dive into our newest collection of articles, offering valuable insights and practical advice across accounting, financial planning, and business strategies. Each piece is tailored to help you stay informed and make confident decisions for your financial future.

When DIY does not pay off

“If you want something done right, you’ve got to do it yourself”

How do retirement options compare?

Retirement is filled with opportunities and choices. There’s the time to travel more, work on long-delayed personal projects or volunteer your help to worthwhile causes

Insuring against loss of income

Protecting income from unexpected illness and injury is particularly important to anyone with a mortgage to service, small business owners and self-employed people with no sick leave available.

Freshen up your professional & personal life

As the seasons change and the air fills with the promise of renewal, it’s the perfect time to have a clean out—not just for your physical space, but for your life and career as well.

Release the value of your home

Rising property prices have led many people to look for ways to unlock the increased equity in their homes so they enjoy a comfortable lifestyle in their golden years.

Have you visited our Bookkeeping and Loans Department Websites yet?

Client Success Stories:

Results Home Loans

Stephanie & William

What the Clients Needed:

- Will is a self-employed painter and Stef is a PAYG chef

- wanted to sell their current home and upsize to a bigger house

- they already found their ideal property which was another unit in their area and was already up for sale

- had an existing loan with ANZ

- initially considered a bridging loan to purchase the new property before selling their current home

- 2024 financials were not finalised yet and might not be strong, so might only use 2023 financials

What We Did:

- Researched lenders that would accept 1 year financials for self-employed clients

- Challenge: We were unable to use Will’s 2023 financials, as the increase from 2022 didn’t meet the lender’s criteria.

- Solution: We waited for Will to do his 2024 tax and we used his 2024 financials, which was higher and more reflective of his current income.

- Recommended a simultaneous settlement instead of a bridging loan, aligning the timing of selling their current home with settling on their new home.

Result:

Successfully secured the loan using Stef’s PAYG income and Will’s 2024 financials.

Their simultaneous settlement was completed.

Emma & Erik

What the Clients Needed:

- We have also helped these clients with their SMSF loan, which settled in August this year

- This time, they wanted to purchase their new owner-occupied home

- They were concerned about Emma’s credit score of 501 and a default (already paid) that was due to be removed in December this year.

What We Did:

- Researched lenders that would accept Emma’s credit score (as most lenders would accept a minimum credit score of 600)

- Discussed potential lenders with the clients and recommended BOM, which offered significantly lower interest rates compared to other lenders.

Result:

The loan was approved and settled successfully, and the clients are now happily living in their new home.

Michael & Megan

What the Clients Needed:

- Clients were living with their respective parents and wanted to take that next step together and buy their first home.

- They wanted to take advantage of any available First Home Buyer grants/concessions but weren’t sure where they stood.

What We Did:

- Challenge 1: Michael was ineligible for the First Home Buyer Guarantee (FHBG) Scheme because he already co-owned an investment property with his mum.

- Challenge 2: Michael had an existing loan for the above investment property with his mum.

- Challenge 3: The property they wanted to purchase had power transmission lines that passed directly over it which was unacceptable to some lenders and limited the amount they could borrow against the property

Result:

We were able to find an out of the box solution for Michael and Megan, workshopped the deal with the lender and help them successfully secure their first home, avoiding LMI and obtaining a great rate at the same time!

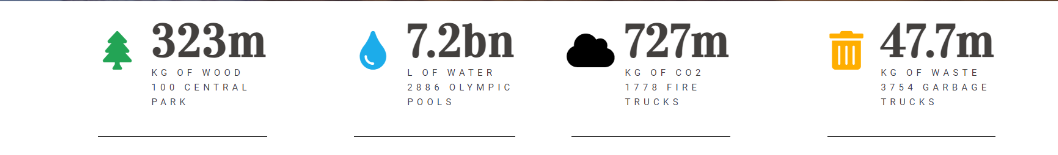

Electronic Signing

At Concepts & Results we ask you to sign documents electronically whenever possible. This can be via Xero, Docusign, or Adobe sign.

You've helped save...

See our previous newsletters below

Visit us

Want to discuss the above face to face? Come visit our specialised team members to find out more.

612 Warrigal Road, East Malvern PO Box 61, Holmesglen, Vic 3148

Call us

Have any questions? Further discussions on the above can be may be held over a telephone appointment.

Contact us

For any and all queries regarding the above, you may contact Concepts & Reuslts by emailing us

DISCLAIMER: Whilst all care is taken in the preparation of the material in this newsletter, the information provided is of a general nature and individuals should seek advice as to their own specific needs. Accordingly, no responsibility for errors or omissions is accepted by Concepts & Results group of companies or any member or employee.