Talking Concepts

September 2024

What's been going on this quarter? Stay current with Concepts & Results and any updates in the market

What's new?

ATO MYDEDUCTION APP

The ATO’s myDeductions tool is FREE to use and is available through the ATO app. The tool makes it easier and more convenient to keep records of your expenses and income in one place, including photos of your receipts and invoices.

You can access the app by clicking on this link: myDeductions | Australian Taxation Office (ato.gov.au)

At the end of a tax year, you can then use this app to email to yourself or to our office all the tax deductions you want to claim. Why not download this app now and start using it immediately to record your tax deductions for the 2025 tax year.

Dates to Remember

21 September 2024 – Monthly IAS – August lodgement and payment due

30 September 2024 – Single Touch Payroll (STP) – end of year finalisation declaration due

21 October 2024 – Monthly IAS – September lodgement and payment due

31 October 2024 – Final date for lodgement of Income Tax Returns if not lodged via a tax agent.

25 November 2024 – Quarterly BAS – September lodgement and payment due

21 November 2024 – Monthly IAS – October lodgement and payment due

28 November 2024 – Quarter 1 Superannuation Guarantee Charge due

INTEREST RATES

Interest Rates that start from…

5.74% p/a Fixed Rate

6.33% p/a Comparison Rate

Based on our lender panel, BOQ’s 3 Year Fixed Rate, provides the most competitive Interest Rate. Interest rates are correct as at 04/09/2024 and subject to change at anytime. The comparison rate is based on a loan amount of $500,000, over a 30 year term. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees and other loan amounts might result in a different comparison rate. Terms, conditions, fees and charges apply and your full financial situation would need to be reviewed prior to acceptance of any offer or product.

It’s tax time again

We’re ready to prepare and lodge your 2024 Tax Return

We have a 2024 Tax Return Questionnaire for you provide us with the information we need for your 2024 Tax Return.

Find it here: 2024 Tax Return Questionnaire

WHEN TO LODGE YOUR 2024 TAX RETURN

Your employer had until 14 July 2024 to finalise your end of year Income Statement (formerly called a Payment Summary). You can check your myGov account to see if your 2024 Income Statement is available.

INFORMATION WE NEED

Here is a summary of the information we need to prepare your 2024 Tax Return. Not all these items may be relevant to you, and after we meet or talk, we may discover additional items that we need to request from you for the period 1 July 2023 to 30 June 2024:

-

Income Statement from your employers

-

Bank interest details

-

Dividend Statements

-

Capital Gains – sale of shares, sale of property, etc

-

Distribution statements from Trusts, Partnerships, Managed Funds, Investments

-

Foreign Income

-

Cryptocurrency transactions – We need to link your crypto wallets to our Crypto Client Management Portal to generate reports for your Tax Return (Note: after we have reviewed your crypto transactions we will provide you with a revised price for your Tax Return due to the extra work required for crypto transactions)

-

Uber driving / rent from AirBNB, Airtasker income, etc

-

Motor vehicle expenses for business use – logbook required

-

Home office expenses – You need to complete a Working from Home Diary

-

Mobile phone and internet costs

-

Tools and equipment

-

Computer expenses

-

Work uniforms and clothing expenses

-

Travel and accommodation costs for work related travel

-

Courses, training and professional development costs

-

Income Protection Insurance premiums paid

-

Rental Statement from your agent - 12-month summary

-

Depreciation Report

-

Loan Statements for Interest

-

Listing of other property expenses, including date paid, payee, amount and what the expense was for

Links to more information about specific deductions

It’s our job as your tax agent to make the lodgement of your Tax Returns as easy and simple as possible.

We do this every day, so we know all the ins and outs of what to claim to make it easy for you.

If you want to have a look at some of the specific deductions you can claim, here are links to the ATO website:

- Clothing, laundry and dry-cleaning expenses

- Gifts and donations

- Working from home expenses

- Investments, interest, insurance and super

- Self-education expenses

- Tools, computers and items you use for work

- Cars, transport and travel – including travel between work and home

We also have lots of handy checklists on our webpage, and Fact Sheets of deductions for specific occupations. https://www.cr.com.au/get-results/tax-checklists/

When you have everything ready contact our office on (03) 9569 5676 or email admingroup@cr.com.au

Do you have an Investment Property and need a Tax Depreciation Report?

Duo Tax Depreciation

*Our preferred supplier due to thier quicker turnaround time*

1300 185 498

george@duotax.com.au

Duo Tax give clients of Concepts & Results a special rate, make sure that you let them know that you have been referred by our company

BMT Tax Depreciation

03 9296 6200

You can order online at http://www.bmtqs.com.au/residential-property-depreciation/. For new properties you will need to provide BMT with a copy of the floor plan, list of specifications and contract price.

BMT give clients of Concepts & Results a special rate, please make sure that you include our name, phone and email when ordering, that way a copy of the report will be emailed direct to our office.

Identity theft

Protect your personal information

If your personal information falls into the wrong hands, it can be used to steal your identity.

If you think your identity has been stolen, report it to your bank and change your passwords. You can also go to https://www.idcare.org/contact/get-help for specialised support.

If identity documents with your Centrelink Customer Reference Number, Medicare or myGov details have been compromised, go to https://www.servicesaustralia.gov.au/what-to-do-if-scam-has-affected-you?context=602716 or call 1800 941 126, Monday to Friday, 8am to 5pm AEST.

If you’ve been affected by a data breach, the Office of the Australian Information Commissioner has information on their webpage https://moneysmart.gov.au/online-safety/protect-yourself-from-scams

It is important to:

- report the breach to your bank and super fund

- change your passwords

- be on the lookout for suspicious emails, phone calls, texts or messages through social media

- keep close watch on your bank account for any unauthorised transactions

- request a temporary ban on your credit report to ensure no unauthorised loans or applications

SIGNS OF IDENTITY THEFT

If your identity has been stolen, you may not realise for some time. These are some signs to look out for:

- Unusual bills or charges that you don’t recognise appear on your bank statement.

- Mail that you’re expecting doesn’t arrive.

- You get calls or texts about products and services you’ve never used.

- Strange emails appear in your inbox.

- A sudden increase in suspicious phone calls, texts or messages through social platforms.

ACT FAST IF YOUR IDENTITY IS STOLEN

What to do if you think your identity has been stolen.

CONTACT YOUR BANK

Contact your bank so they can block the account. This will stop a scammer from accessing your money. You may also need to cancel any credit or debit cards linked to your accounts.

CONTACT IDCARE

IDCARE is Australia and New Zealand’s national identity and cyber support service. They can help you make a plan (for free) to limit the damage of identity theft. Call 1800 595 160 or visit https://www.idcare.org/

CHANGE YOUR PASSWORDS

If someone has stolen your identity, they may know your passwords. Change your passwords straight away. Think about all of your online accounts, including social media and other bank accounts.

REPORT THE FRAUD

If you think your personal information has been used, you can report it to the police via https://www.cyber.gov.au/report-and-recover/report.

REPORT IT TO THE RELEVANT WEBSITES

If you think someone has hacked into your online accounts, report it to the relevant websites.

ALERT FAMILY AND FRIENDS

If someone has taken over your social media accounts or your email address, alert your family and friends. Tell them to block the account.

REPORT IT TO SCAMWATCH

Scamwatch, run by the National Anti-Scam Centre (NASC), collects data about scams in Australia. Your report helps Scamwatch raise awareness about how to recognise, avoid and report scams. NASC also shares intelligence and works with government, law enforcement and the private sector to disrupt and prevent scams. https://www.scamwatch.gov.au/report-a-scam

PROTECT YOURSELF FROM IDENTITY FRAUD

Simple steps you can take to avoid identity theft.

USE STRONG PASSWORDS

Make sure your passwords are long and contain a mix of numbers, symbols, capital letters and lowercase letters. Strong passwords make it harder for people to hack into your accounts.

The Australian Cyber Security Centre (ACSC) has some useful tips on creating a strong password or passphrase. https://www.cyber.gov.au/protect-yourself/securing-your-accounts/passphrases

SHRED YOUR DOCUMENTS

Letters from your bank, super fund and employer can all contain personal details scammers can use to steal your identity. Shred these kinds of letters before you throw them out.

USE PUBLIC COMPUTERS WITH CAUTION

If you use a public computer, for example, at a library, make sure you clear your internet history and log out of your accounts.

BE CAREFUL ON SOCIAL MEDIA

Be aware of what you post on social media, particularly if your profile is public. Scammers can find out where you live, work and visit through your posts.

USE SECUIRTY SOFTWARE ON YOUR COMPUTER

Use virus protection software to help stop hackers from accessing your information. This software can help protect you if you click on a suspicious link or visit a fake website.

MONITOR YOUR BANK TRANSACTIONS

Check your bank statements and online accounts regularly for unusual transactions. If you spot something unusual, check it with your bank and find out if you need to act.

REQUEST A COPY OF YOUR CREDIT REPORT

Check your credit report for any unusual or incorrect debts, loans or credit applications. If you suspect fraud, you can request a temporary ban at https://www.oaic.gov.au/privacy/your-privacy-rights/credit-reporting/fraud-and-your-credit-report. Find out how to get a free copy of your credit report https://moneysmart.gov.au/managing-debt/credit-scores-and-credit-reports

SECURE YOUR MAIL

Put a lock on your street mailbox so that people can’t steal your mail.

The latest tax audit claim stats you will want to know

Our third party Audit Shield providers have conducted an analysis of claims documented between 1 July 2023 and 30 June 2024.

These insights provide a snapshot of the areas on which government revenue authorities, such as the Australian Taxation Office (ATO) and the State Revenue Office (SRO), are focusing.

Explore the key highlights of the ATO and other government revenue authorities’ audit claim trends during this period in their latest article.

Have you visited our Bookkeeping Department Website yet?

Have you visited our Loans Department Website yet?

RBA ‘doesn’t expect inflation to be back to 2 – 3% until the end of 2025

Michele Bullock, the governor of the Reserve Bank of Australia (RBA), addressed the recent decision to hold the cash rate during a speech at the Rotary Club of Armidale Annual Lecture on August 8th. The decision was made to maintain economic stability by keeping inflation in check, aiming for a target range of 2-3%, while also striving to keep unemployment low.

Bullock explained that balancing inflation and unemployment is complex, especially in the wake of the pandemic, which caused a global surge in inflation due to supply chain disruptions and increased demand. Despite rising interest rates, inflation remains high in Australia, with the RBA projecting that it won’t return to the target range until the end of 2025.

The decision to hold the cash rate, which currently sits at 4.35%, was influenced by the desire to prevent further economic imbalance while recognizing the persistent inflation. Bullock emphasized that while the RBA is focused on reducing inflation, they are cautious and prepared to raise rates again if necessary to protect the economy from the dangers of sustained high inflation.

Electronic Signing

At Concepts & Results we ask you to sign documents electronically whenever possible. This can be via Xero, Docusign, or Adobe sign.

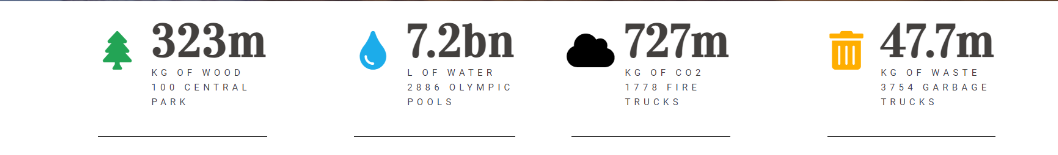

You’ve Helped save…

See our previous newsletters below

Visit us

Want to discuss the above face to face? Come visit our specialised team members to find out more.

612 Warrigal Road, East Malvern PO Box 61, Holmesglen, Vic 3148

Call us

Have any questions? Further discussions on the above can be may be held over a telephone appointment.

Contact us

For any and all queries regarding the above, you may contact Concepts & Reuslts by emailing us

DISCLAIMER: Whilst all care is taken in the preparation of the material in this newsletter, the information provided is of a general nature and individuals should seek advice as to their own specific needs. Accordingly, no responsibility for errors or omissions is accepted by Concepts & Results group of companies or any member or employee.